等额本金和等额本息比较分析

楚新元 / 2022-12-11

提出需求

贷款 100 万,贷款利率为 6%(年利率),贷款期限 15 年。分别计算等额本金和等额本息两种还款方式下每月偿还本金、偿还利息、偿还本息、剩余本金。并对两种还款方式进行比较分析。

加载相关R包

library(ggplot2)

library(dplyr)

library(kableExtra)

options(digits = 6)

参数设置

# 设置贷款余额value

value = 1000000

# 设置贷款利率rate

rate = 0.06

# 设置贷款期限term

term = 15

# 设置还款方式mode

mode1 = 1 # 等额本金

mode2 = 2 # 等额本息

编写函数

repayment = function(value, rate, term, mode) {

# 年利率换算为月利率

rate_m = rate / 12

# 还款期限换算成月

t = term * 12

# 生成还款期次向量

N = 1:t # 还款期次

# 等额本金模式

if (mode == 1) {

MBA = value / t # 每月应还本金

MYA = value - MBA * (N-1) # 截至当月还款前贷款余额

MYAA = value - MBA * N # 还贷后剩余本金

MIA = MYA * rate_m # 当月应还利息

MPA = MIA + MBA # 当月应还本息和

tbl = data.frame(N, MYA, MBA, MIA, MPA, MYAA)

colnames(tbl) = c(

"还款期次", "贷款余额", "应还本金",

"应还利息", "应还本息", "剩余本金"

)

}

# 等额本息模式

if (mode == 2) {

# 每月应还的等额本息

MPB = value * rate_m * (1 + rate_m)^t / ((1 + rate_m)^t - 1)

# 截至当月还款前贷款余额

MYB = value *(1 + rate_m)^(N-1) - MPB * ((1 + rate_m)^(N-1) - 1) / rate_m

MIB = MYB * rate_m # 当月应还利息

MBB = MPB - MIB # 当月应还本金

MYBB = MYB - MBB # 剩余本金

tbl = data.frame(N, MYB, MBB, MIB, MPB, MYBB)

colnames(tbl) = c(

"还款期次", "贷款余额", "应还本金",

"应还利息", "应还本息", "剩余本金"

)

}

# 返回生成的数据框

return(tbl)

}

生成还款表验证函数

生成等额本金还款表

# 计算等额本金

df1 = repayment(

value = value,

rate = rate,

term = term,

mode = mode1

)

df1 %>%

kable() %>%

kable_styling(font_size = 12)

| 还款期次 | 贷款余额 | 应还本金 | 应还利息 | 应还本息 | 剩余本金 |

|---|---|---|---|---|---|

| 1 | 1000000.00 | 5555.56 | 5000.0000 | 10555.56 | 994444.44 |

| 2 | 994444.44 | 5555.56 | 4972.2222 | 10527.78 | 988888.89 |

| 3 | 988888.89 | 5555.56 | 4944.4444 | 10500.00 | 983333.33 |

| 4 | 983333.33 | 5555.56 | 4916.6667 | 10472.22 | 977777.78 |

| 5 | 977777.78 | 5555.56 | 4888.8889 | 10444.44 | 972222.22 |

| 6 | 972222.22 | 5555.56 | 4861.1111 | 10416.67 | 966666.67 |

| 7 | 966666.67 | 5555.56 | 4833.3333 | 10388.89 | 961111.11 |

| 8 | 961111.11 | 5555.56 | 4805.5556 | 10361.11 | 955555.56 |

| 9 | 955555.56 | 5555.56 | 4777.7778 | 10333.33 | 950000.00 |

| 10 | 950000.00 | 5555.56 | 4750.0000 | 10305.56 | 944444.44 |

| 11 | 944444.44 | 5555.56 | 4722.2222 | 10277.78 | 938888.89 |

| 12 | 938888.89 | 5555.56 | 4694.4444 | 10250.00 | 933333.33 |

| 13 | 933333.33 | 5555.56 | 4666.6667 | 10222.22 | 927777.78 |

| 14 | 927777.78 | 5555.56 | 4638.8889 | 10194.44 | 922222.22 |

| 15 | 922222.22 | 5555.56 | 4611.1111 | 10166.67 | 916666.67 |

| 16 | 916666.67 | 5555.56 | 4583.3333 | 10138.89 | 911111.11 |

| 17 | 911111.11 | 5555.56 | 4555.5556 | 10111.11 | 905555.56 |

| 18 | 905555.56 | 5555.56 | 4527.7778 | 10083.33 | 900000.00 |

| 19 | 900000.00 | 5555.56 | 4500.0000 | 10055.56 | 894444.44 |

| 20 | 894444.44 | 5555.56 | 4472.2222 | 10027.78 | 888888.89 |

| 21 | 888888.89 | 5555.56 | 4444.4444 | 10000.00 | 883333.33 |

| 22 | 883333.33 | 5555.56 | 4416.6667 | 9972.22 | 877777.78 |

| 23 | 877777.78 | 5555.56 | 4388.8889 | 9944.44 | 872222.22 |

| 24 | 872222.22 | 5555.56 | 4361.1111 | 9916.67 | 866666.67 |

| 25 | 866666.67 | 5555.56 | 4333.3333 | 9888.89 | 861111.11 |

| 26 | 861111.11 | 5555.56 | 4305.5556 | 9861.11 | 855555.56 |

| 27 | 855555.56 | 5555.56 | 4277.7778 | 9833.33 | 850000.00 |

| 28 | 850000.00 | 5555.56 | 4250.0000 | 9805.56 | 844444.44 |

| 29 | 844444.44 | 5555.56 | 4222.2222 | 9777.78 | 838888.89 |

| 30 | 838888.89 | 5555.56 | 4194.4444 | 9750.00 | 833333.33 |

| 31 | 833333.33 | 5555.56 | 4166.6667 | 9722.22 | 827777.78 |

| 32 | 827777.78 | 5555.56 | 4138.8889 | 9694.44 | 822222.22 |

| 33 | 822222.22 | 5555.56 | 4111.1111 | 9666.67 | 816666.67 |

| 34 | 816666.67 | 5555.56 | 4083.3333 | 9638.89 | 811111.11 |

| 35 | 811111.11 | 5555.56 | 4055.5556 | 9611.11 | 805555.56 |

| 36 | 805555.56 | 5555.56 | 4027.7778 | 9583.33 | 800000.00 |

| 37 | 800000.00 | 5555.56 | 4000.0000 | 9555.56 | 794444.44 |

| 38 | 794444.44 | 5555.56 | 3972.2222 | 9527.78 | 788888.89 |

| 39 | 788888.89 | 5555.56 | 3944.4444 | 9500.00 | 783333.33 |

| 40 | 783333.33 | 5555.56 | 3916.6667 | 9472.22 | 777777.78 |

| 41 | 777777.78 | 5555.56 | 3888.8889 | 9444.44 | 772222.22 |

| 42 | 772222.22 | 5555.56 | 3861.1111 | 9416.67 | 766666.67 |

| 43 | 766666.67 | 5555.56 | 3833.3333 | 9388.89 | 761111.11 |

| 44 | 761111.11 | 5555.56 | 3805.5556 | 9361.11 | 755555.56 |

| 45 | 755555.56 | 5555.56 | 3777.7778 | 9333.33 | 750000.00 |

| 46 | 750000.00 | 5555.56 | 3750.0000 | 9305.56 | 744444.44 |

| 47 | 744444.44 | 5555.56 | 3722.2222 | 9277.78 | 738888.89 |

| 48 | 738888.89 | 5555.56 | 3694.4444 | 9250.00 | 733333.33 |

| 49 | 733333.33 | 5555.56 | 3666.6667 | 9222.22 | 727777.78 |

| 50 | 727777.78 | 5555.56 | 3638.8889 | 9194.44 | 722222.22 |

| 51 | 722222.22 | 5555.56 | 3611.1111 | 9166.67 | 716666.67 |

| 52 | 716666.67 | 5555.56 | 3583.3333 | 9138.89 | 711111.11 |

| 53 | 711111.11 | 5555.56 | 3555.5556 | 9111.11 | 705555.56 |

| 54 | 705555.56 | 5555.56 | 3527.7778 | 9083.33 | 700000.00 |

| 55 | 700000.00 | 5555.56 | 3500.0000 | 9055.56 | 694444.44 |

| 56 | 694444.44 | 5555.56 | 3472.2222 | 9027.78 | 688888.89 |

| 57 | 688888.89 | 5555.56 | 3444.4444 | 9000.00 | 683333.33 |

| 58 | 683333.33 | 5555.56 | 3416.6667 | 8972.22 | 677777.78 |

| 59 | 677777.78 | 5555.56 | 3388.8889 | 8944.44 | 672222.22 |

| 60 | 672222.22 | 5555.56 | 3361.1111 | 8916.67 | 666666.67 |

| 61 | 666666.67 | 5555.56 | 3333.3333 | 8888.89 | 661111.11 |

| 62 | 661111.11 | 5555.56 | 3305.5556 | 8861.11 | 655555.56 |

| 63 | 655555.56 | 5555.56 | 3277.7778 | 8833.33 | 650000.00 |

| 64 | 650000.00 | 5555.56 | 3250.0000 | 8805.56 | 644444.44 |

| 65 | 644444.44 | 5555.56 | 3222.2222 | 8777.78 | 638888.89 |

| 66 | 638888.89 | 5555.56 | 3194.4444 | 8750.00 | 633333.33 |

| 67 | 633333.33 | 5555.56 | 3166.6667 | 8722.22 | 627777.78 |

| 68 | 627777.78 | 5555.56 | 3138.8889 | 8694.44 | 622222.22 |

| 69 | 622222.22 | 5555.56 | 3111.1111 | 8666.67 | 616666.67 |

| 70 | 616666.67 | 5555.56 | 3083.3333 | 8638.89 | 611111.11 |

| 71 | 611111.11 | 5555.56 | 3055.5556 | 8611.11 | 605555.56 |

| 72 | 605555.56 | 5555.56 | 3027.7778 | 8583.33 | 600000.00 |

| 73 | 600000.00 | 5555.56 | 3000.0000 | 8555.56 | 594444.44 |

| 74 | 594444.44 | 5555.56 | 2972.2222 | 8527.78 | 588888.89 |

| 75 | 588888.89 | 5555.56 | 2944.4444 | 8500.00 | 583333.33 |

| 76 | 583333.33 | 5555.56 | 2916.6667 | 8472.22 | 577777.78 |

| 77 | 577777.78 | 5555.56 | 2888.8889 | 8444.44 | 572222.22 |

| 78 | 572222.22 | 5555.56 | 2861.1111 | 8416.67 | 566666.67 |

| 79 | 566666.67 | 5555.56 | 2833.3333 | 8388.89 | 561111.11 |

| 80 | 561111.11 | 5555.56 | 2805.5556 | 8361.11 | 555555.56 |

| 81 | 555555.56 | 5555.56 | 2777.7778 | 8333.33 | 550000.00 |

| 82 | 550000.00 | 5555.56 | 2750.0000 | 8305.56 | 544444.44 |

| 83 | 544444.44 | 5555.56 | 2722.2222 | 8277.78 | 538888.89 |

| 84 | 538888.89 | 5555.56 | 2694.4444 | 8250.00 | 533333.33 |

| 85 | 533333.33 | 5555.56 | 2666.6667 | 8222.22 | 527777.78 |

| 86 | 527777.78 | 5555.56 | 2638.8889 | 8194.44 | 522222.22 |

| 87 | 522222.22 | 5555.56 | 2611.1111 | 8166.67 | 516666.67 |

| 88 | 516666.67 | 5555.56 | 2583.3333 | 8138.89 | 511111.11 |

| 89 | 511111.11 | 5555.56 | 2555.5556 | 8111.11 | 505555.56 |

| 90 | 505555.56 | 5555.56 | 2527.7778 | 8083.33 | 500000.00 |

| 91 | 500000.00 | 5555.56 | 2500.0000 | 8055.56 | 494444.44 |

| 92 | 494444.44 | 5555.56 | 2472.2222 | 8027.78 | 488888.89 |

| 93 | 488888.89 | 5555.56 | 2444.4444 | 8000.00 | 483333.33 |

| 94 | 483333.33 | 5555.56 | 2416.6667 | 7972.22 | 477777.78 |

| 95 | 477777.78 | 5555.56 | 2388.8889 | 7944.44 | 472222.22 |

| 96 | 472222.22 | 5555.56 | 2361.1111 | 7916.67 | 466666.67 |

| 97 | 466666.67 | 5555.56 | 2333.3333 | 7888.89 | 461111.11 |

| 98 | 461111.11 | 5555.56 | 2305.5556 | 7861.11 | 455555.56 |

| 99 | 455555.56 | 5555.56 | 2277.7778 | 7833.33 | 450000.00 |

| 100 | 450000.00 | 5555.56 | 2250.0000 | 7805.56 | 444444.44 |

| 101 | 444444.44 | 5555.56 | 2222.2222 | 7777.78 | 438888.89 |

| 102 | 438888.89 | 5555.56 | 2194.4444 | 7750.00 | 433333.33 |

| 103 | 433333.33 | 5555.56 | 2166.6667 | 7722.22 | 427777.78 |

| 104 | 427777.78 | 5555.56 | 2138.8889 | 7694.44 | 422222.22 |

| 105 | 422222.22 | 5555.56 | 2111.1111 | 7666.67 | 416666.67 |

| 106 | 416666.67 | 5555.56 | 2083.3333 | 7638.89 | 411111.11 |

| 107 | 411111.11 | 5555.56 | 2055.5556 | 7611.11 | 405555.56 |

| 108 | 405555.56 | 5555.56 | 2027.7778 | 7583.33 | 400000.00 |

| 109 | 400000.00 | 5555.56 | 2000.0000 | 7555.56 | 394444.44 |

| 110 | 394444.44 | 5555.56 | 1972.2222 | 7527.78 | 388888.89 |

| 111 | 388888.89 | 5555.56 | 1944.4444 | 7500.00 | 383333.33 |

| 112 | 383333.33 | 5555.56 | 1916.6667 | 7472.22 | 377777.78 |

| 113 | 377777.78 | 5555.56 | 1888.8889 | 7444.44 | 372222.22 |

| 114 | 372222.22 | 5555.56 | 1861.1111 | 7416.67 | 366666.67 |

| 115 | 366666.67 | 5555.56 | 1833.3333 | 7388.89 | 361111.11 |

| 116 | 361111.11 | 5555.56 | 1805.5556 | 7361.11 | 355555.56 |

| 117 | 355555.56 | 5555.56 | 1777.7778 | 7333.33 | 350000.00 |

| 118 | 350000.00 | 5555.56 | 1750.0000 | 7305.56 | 344444.44 |

| 119 | 344444.44 | 5555.56 | 1722.2222 | 7277.78 | 338888.89 |

| 120 | 338888.89 | 5555.56 | 1694.4444 | 7250.00 | 333333.33 |

| 121 | 333333.33 | 5555.56 | 1666.6667 | 7222.22 | 327777.78 |

| 122 | 327777.78 | 5555.56 | 1638.8889 | 7194.44 | 322222.22 |

| 123 | 322222.22 | 5555.56 | 1611.1111 | 7166.67 | 316666.67 |

| 124 | 316666.67 | 5555.56 | 1583.3333 | 7138.89 | 311111.11 |

| 125 | 311111.11 | 5555.56 | 1555.5556 | 7111.11 | 305555.56 |

| 126 | 305555.56 | 5555.56 | 1527.7778 | 7083.33 | 300000.00 |

| 127 | 300000.00 | 5555.56 | 1500.0000 | 7055.56 | 294444.44 |

| 128 | 294444.44 | 5555.56 | 1472.2222 | 7027.78 | 288888.89 |

| 129 | 288888.89 | 5555.56 | 1444.4444 | 7000.00 | 283333.33 |

| 130 | 283333.33 | 5555.56 | 1416.6667 | 6972.22 | 277777.78 |

| 131 | 277777.78 | 5555.56 | 1388.8889 | 6944.44 | 272222.22 |

| 132 | 272222.22 | 5555.56 | 1361.1111 | 6916.67 | 266666.67 |

| 133 | 266666.67 | 5555.56 | 1333.3333 | 6888.89 | 261111.11 |

| 134 | 261111.11 | 5555.56 | 1305.5556 | 6861.11 | 255555.56 |

| 135 | 255555.56 | 5555.56 | 1277.7778 | 6833.33 | 250000.00 |

| 136 | 250000.00 | 5555.56 | 1250.0000 | 6805.56 | 244444.44 |

| 137 | 244444.44 | 5555.56 | 1222.2222 | 6777.78 | 238888.89 |

| 138 | 238888.89 | 5555.56 | 1194.4444 | 6750.00 | 233333.33 |

| 139 | 233333.33 | 5555.56 | 1166.6667 | 6722.22 | 227777.78 |

| 140 | 227777.78 | 5555.56 | 1138.8889 | 6694.44 | 222222.22 |

| 141 | 222222.22 | 5555.56 | 1111.1111 | 6666.67 | 216666.67 |

| 142 | 216666.67 | 5555.56 | 1083.3333 | 6638.89 | 211111.11 |

| 143 | 211111.11 | 5555.56 | 1055.5556 | 6611.11 | 205555.56 |

| 144 | 205555.56 | 5555.56 | 1027.7778 | 6583.33 | 200000.00 |

| 145 | 200000.00 | 5555.56 | 1000.0000 | 6555.56 | 194444.44 |

| 146 | 194444.44 | 5555.56 | 972.2222 | 6527.78 | 188888.89 |

| 147 | 188888.89 | 5555.56 | 944.4444 | 6500.00 | 183333.33 |

| 148 | 183333.33 | 5555.56 | 916.6667 | 6472.22 | 177777.78 |

| 149 | 177777.78 | 5555.56 | 888.8889 | 6444.44 | 172222.22 |

| 150 | 172222.22 | 5555.56 | 861.1111 | 6416.67 | 166666.67 |

| 151 | 166666.67 | 5555.56 | 833.3333 | 6388.89 | 161111.11 |

| 152 | 161111.11 | 5555.56 | 805.5556 | 6361.11 | 155555.56 |

| 153 | 155555.56 | 5555.56 | 777.7778 | 6333.33 | 150000.00 |

| 154 | 150000.00 | 5555.56 | 750.0000 | 6305.56 | 144444.44 |

| 155 | 144444.44 | 5555.56 | 722.2222 | 6277.78 | 138888.89 |

| 156 | 138888.89 | 5555.56 | 694.4444 | 6250.00 | 133333.33 |

| 157 | 133333.33 | 5555.56 | 666.6667 | 6222.22 | 127777.78 |

| 158 | 127777.78 | 5555.56 | 638.8889 | 6194.44 | 122222.22 |

| 159 | 122222.22 | 5555.56 | 611.1111 | 6166.67 | 116666.67 |

| 160 | 116666.67 | 5555.56 | 583.3333 | 6138.89 | 111111.11 |

| 161 | 111111.11 | 5555.56 | 555.5556 | 6111.11 | 105555.56 |

| 162 | 105555.56 | 5555.56 | 527.7778 | 6083.33 | 100000.00 |

| 163 | 100000.00 | 5555.56 | 500.0000 | 6055.56 | 94444.44 |

| 164 | 94444.44 | 5555.56 | 472.2222 | 6027.78 | 88888.89 |

| 165 | 88888.89 | 5555.56 | 444.4444 | 6000.00 | 83333.33 |

| 166 | 83333.33 | 5555.56 | 416.6667 | 5972.22 | 77777.78 |

| 167 | 77777.78 | 5555.56 | 388.8889 | 5944.44 | 72222.22 |

| 168 | 72222.22 | 5555.56 | 361.1111 | 5916.67 | 66666.67 |

| 169 | 66666.67 | 5555.56 | 333.3333 | 5888.89 | 61111.11 |

| 170 | 61111.11 | 5555.56 | 305.5556 | 5861.11 | 55555.56 |

| 171 | 55555.56 | 5555.56 | 277.7778 | 5833.33 | 50000.00 |

| 172 | 50000.00 | 5555.56 | 250.0000 | 5805.56 | 44444.44 |

| 173 | 44444.44 | 5555.56 | 222.2222 | 5777.78 | 38888.89 |

| 174 | 38888.89 | 5555.56 | 194.4444 | 5750.00 | 33333.33 |

| 175 | 33333.33 | 5555.56 | 166.6667 | 5722.22 | 27777.78 |

| 176 | 27777.78 | 5555.56 | 138.8889 | 5694.44 | 22222.22 |

| 177 | 22222.22 | 5555.56 | 111.1111 | 5666.67 | 16666.67 |

| 178 | 16666.67 | 5555.56 | 83.3333 | 5638.89 | 11111.11 |

| 179 | 11111.11 | 5555.56 | 55.5556 | 5611.11 | 5555.56 |

| 180 | 5555.56 | 5555.56 | 27.7778 | 5583.33 | 0.00 |

生成等额本息还款表

# 计算等额本息

df2 = repayment(

value = value,

rate = rate,

term = term,

mode = mode2

)

df2 %>%

kable() %>%

kable_styling(font_size = 12)

| 还款期次 | 贷款余额 | 应还本金 | 应还利息 | 应还本息 | 剩余本金 |

|---|---|---|---|---|---|

| 1 | 1000000.00 | 3438.57 | 5000.0000 | 8438.57 | 996561.43 |

| 2 | 996561.43 | 3455.76 | 4982.8072 | 8438.57 | 993105.67 |

| 3 | 993105.67 | 3473.04 | 4965.5284 | 8438.57 | 989632.63 |

| 4 | 989632.63 | 3490.41 | 4948.1632 | 8438.57 | 986142.23 |

| 5 | 986142.23 | 3507.86 | 4930.7111 | 8438.57 | 982634.37 |

| 6 | 982634.37 | 3525.40 | 4913.1718 | 8438.57 | 979108.97 |

| 7 | 979108.97 | 3543.02 | 4895.5449 | 8438.57 | 975565.95 |

| 8 | 975565.95 | 3560.74 | 4877.8297 | 8438.57 | 972005.21 |

| 9 | 972005.21 | 3578.54 | 4860.0261 | 8438.57 | 968426.67 |

| 10 | 968426.67 | 3596.43 | 4842.1333 | 8438.57 | 964830.23 |

| 11 | 964830.23 | 3614.42 | 4824.1512 | 8438.57 | 961215.82 |

| 12 | 961215.82 | 3632.49 | 4806.0791 | 8438.57 | 957583.33 |

| 13 | 957583.33 | 3650.65 | 4787.9166 | 8438.57 | 953932.67 |

| 14 | 953932.67 | 3668.90 | 4769.6634 | 8438.57 | 950263.77 |

| 15 | 950263.77 | 3687.25 | 4751.3188 | 8438.57 | 946576.52 |

| 16 | 946576.52 | 3705.69 | 4732.8826 | 8438.57 | 942870.83 |

| 17 | 942870.83 | 3724.21 | 4714.3542 | 8438.57 | 939146.62 |

| 18 | 939146.62 | 3742.84 | 4695.7331 | 8438.57 | 935403.79 |

| 19 | 935403.79 | 3761.55 | 4677.0189 | 8438.57 | 931642.24 |

| 20 | 931642.24 | 3780.36 | 4658.2112 | 8438.57 | 927861.88 |

| 21 | 927861.88 | 3799.26 | 4639.3094 | 8438.57 | 924062.62 |

| 22 | 924062.62 | 3818.26 | 4620.3131 | 8438.57 | 920244.37 |

| 23 | 920244.37 | 3837.35 | 4601.2218 | 8438.57 | 916407.02 |

| 24 | 916407.02 | 3856.53 | 4582.0351 | 8438.57 | 912550.49 |

| 25 | 912550.49 | 3875.82 | 4562.7524 | 8438.57 | 908674.67 |

| 26 | 908674.67 | 3895.19 | 4543.3733 | 8438.57 | 904779.47 |

| 27 | 904779.47 | 3914.67 | 4523.8974 | 8438.57 | 900864.80 |

| 28 | 900864.80 | 3934.24 | 4504.3240 | 8438.57 | 896930.56 |

| 29 | 896930.56 | 3953.92 | 4484.6528 | 8438.57 | 892976.64 |

| 30 | 892976.64 | 3973.69 | 4464.8832 | 8438.57 | 889002.96 |

| 31 | 889002.96 | 3993.55 | 4445.0148 | 8438.57 | 885009.41 |

| 32 | 885009.41 | 4013.52 | 4425.0470 | 8438.57 | 880995.88 |

| 33 | 880995.88 | 4033.59 | 4404.9794 | 8438.57 | 876962.30 |

| 34 | 876962.30 | 4053.76 | 4384.8115 | 8438.57 | 872908.54 |

| 35 | 872908.54 | 4074.03 | 4364.5427 | 8438.57 | 868834.51 |

| 36 | 868834.51 | 4094.40 | 4344.1726 | 8438.57 | 864740.12 |

| 37 | 864740.12 | 4114.87 | 4323.7006 | 8438.57 | 860625.25 |

| 38 | 860625.25 | 4135.44 | 4303.1262 | 8438.57 | 856489.81 |

| 39 | 856489.81 | 4156.12 | 4282.4490 | 8438.57 | 852333.69 |

| 40 | 852333.69 | 4176.90 | 4261.6684 | 8438.57 | 848156.79 |

| 41 | 848156.79 | 4197.78 | 4240.7839 | 8438.57 | 843959.00 |

| 42 | 843959.00 | 4218.77 | 4219.7950 | 8438.57 | 839740.23 |

| 43 | 839740.23 | 4239.87 | 4198.7012 | 8438.57 | 835500.36 |

| 44 | 835500.36 | 4261.07 | 4177.5018 | 8438.57 | 831239.30 |

| 45 | 831239.30 | 4282.37 | 4156.1965 | 8438.57 | 826956.93 |

| 46 | 826956.93 | 4303.78 | 4134.7846 | 8438.57 | 822653.14 |

| 47 | 822653.14 | 4325.30 | 4113.2657 | 8438.57 | 818327.84 |

| 48 | 818327.84 | 4346.93 | 4091.6392 | 8438.57 | 813980.91 |

| 49 | 813980.91 | 4368.66 | 4069.9046 | 8438.57 | 809612.25 |

| 50 | 809612.25 | 4390.51 | 4048.0612 | 8438.57 | 805221.74 |

| 51 | 805221.74 | 4412.46 | 4026.1087 | 8438.57 | 800809.28 |

| 52 | 800809.28 | 4434.52 | 4004.0464 | 8438.57 | 796374.76 |

| 53 | 796374.76 | 4456.69 | 3981.8738 | 8438.57 | 791918.06 |

| 54 | 791918.06 | 4478.98 | 3959.5903 | 8438.57 | 787439.09 |

| 55 | 787439.09 | 4501.37 | 3937.1954 | 8438.57 | 782937.71 |

| 56 | 782937.71 | 4523.88 | 3914.6886 | 8438.57 | 778413.83 |

| 57 | 778413.83 | 4546.50 | 3892.0692 | 8438.57 | 773867.33 |

| 58 | 773867.33 | 4569.23 | 3869.3367 | 8438.57 | 769298.10 |

| 59 | 769298.10 | 4592.08 | 3846.4905 | 8438.57 | 764706.02 |

| 60 | 764706.02 | 4615.04 | 3823.5301 | 8438.57 | 760090.99 |

| 61 | 760090.99 | 4638.11 | 3800.4549 | 8438.57 | 755452.87 |

| 62 | 755452.87 | 4661.30 | 3777.2644 | 8438.57 | 750791.57 |

| 63 | 750791.57 | 4684.61 | 3753.9578 | 8438.57 | 746106.96 |

| 64 | 746106.96 | 4708.03 | 3730.5348 | 8438.57 | 741398.92 |

| 65 | 741398.92 | 4731.57 | 3706.9946 | 8438.57 | 736667.35 |

| 66 | 736667.35 | 4755.23 | 3683.3368 | 8438.57 | 731912.12 |

| 67 | 731912.12 | 4779.01 | 3659.5606 | 8438.57 | 727133.11 |

| 68 | 727133.11 | 4802.90 | 3635.6656 | 8438.57 | 722330.21 |

| 69 | 722330.21 | 4826.92 | 3611.6510 | 8438.57 | 717503.29 |

| 70 | 717503.29 | 4851.05 | 3587.5165 | 8438.57 | 712652.24 |

| 71 | 712652.24 | 4875.31 | 3563.2612 | 8438.57 | 707776.93 |

| 72 | 707776.93 | 4899.68 | 3538.8847 | 8438.57 | 702877.25 |

| 73 | 702877.25 | 4924.18 | 3514.3862 | 8438.57 | 697953.07 |

| 74 | 697953.07 | 4948.80 | 3489.7653 | 8438.57 | 693004.26 |

| 75 | 693004.26 | 4973.55 | 3465.0213 | 8438.57 | 688030.72 |

| 76 | 688030.72 | 4998.41 | 3440.1536 | 8438.57 | 683032.30 |

| 77 | 683032.30 | 5023.41 | 3415.1615 | 8438.57 | 678008.90 |

| 78 | 678008.90 | 5048.52 | 3390.0445 | 8438.57 | 672960.37 |

| 79 | 672960.37 | 5073.77 | 3364.8019 | 8438.57 | 667886.61 |

| 80 | 667886.61 | 5099.14 | 3339.4330 | 8438.57 | 662787.47 |

| 81 | 662787.47 | 5124.63 | 3313.9374 | 8438.57 | 657662.84 |

| 82 | 657662.84 | 5150.25 | 3288.3142 | 8438.57 | 652512.59 |

| 83 | 652512.59 | 5176.01 | 3262.5629 | 8438.57 | 647336.58 |

| 84 | 647336.58 | 5201.89 | 3236.6829 | 8438.57 | 642134.70 |

| 85 | 642134.70 | 5227.89 | 3210.6735 | 8438.57 | 636906.80 |

| 86 | 636906.80 | 5254.03 | 3184.5340 | 8438.57 | 631652.77 |

| 87 | 631652.77 | 5280.30 | 3158.2638 | 8438.57 | 626372.46 |

| 88 | 626372.46 | 5306.71 | 3131.8623 | 8438.57 | 621065.76 |

| 89 | 621065.76 | 5333.24 | 3105.3288 | 8438.57 | 615732.52 |

| 90 | 615732.52 | 5359.91 | 3078.6626 | 8438.57 | 610372.61 |

| 91 | 610372.61 | 5386.71 | 3051.8631 | 8438.57 | 604985.91 |

| 92 | 604985.91 | 5413.64 | 3024.9295 | 8438.57 | 599572.27 |

| 93 | 599572.27 | 5440.71 | 2997.8613 | 8438.57 | 594131.56 |

| 94 | 594131.56 | 5467.91 | 2970.6578 | 8438.57 | 588663.65 |

| 95 | 588663.65 | 5495.25 | 2943.3182 | 8438.57 | 583168.40 |

| 96 | 583168.40 | 5522.73 | 2915.8420 | 8438.57 | 577645.67 |

| 97 | 577645.67 | 5550.34 | 2888.2284 | 8438.57 | 572095.33 |

| 98 | 572095.33 | 5578.09 | 2860.4767 | 8438.57 | 566517.24 |

| 99 | 566517.24 | 5605.98 | 2832.5862 | 8438.57 | 560911.26 |

| 100 | 560911.26 | 5634.01 | 2804.5563 | 8438.57 | 555277.25 |

| 101 | 555277.25 | 5662.18 | 2776.3862 | 8438.57 | 549615.06 |

| 102 | 549615.06 | 5690.49 | 2748.0753 | 8438.57 | 543924.57 |

| 103 | 543924.57 | 5718.95 | 2719.6229 | 8438.57 | 538205.63 |

| 104 | 538205.63 | 5747.54 | 2691.0281 | 8438.57 | 532458.09 |

| 105 | 532458.09 | 5776.28 | 2662.2904 | 8438.57 | 526681.81 |

| 106 | 526681.81 | 5805.16 | 2633.4090 | 8438.57 | 520876.65 |

| 107 | 520876.65 | 5834.19 | 2604.3832 | 8438.57 | 515042.46 |

| 108 | 515042.46 | 5863.36 | 2575.2123 | 8438.57 | 509179.11 |

| 109 | 509179.11 | 5892.67 | 2545.8955 | 8438.57 | 503286.44 |

| 110 | 503286.44 | 5922.14 | 2516.4322 | 8438.57 | 497364.30 |

| 111 | 497364.30 | 5951.75 | 2486.8215 | 8438.57 | 491412.55 |

| 112 | 491412.55 | 5981.51 | 2457.0628 | 8438.57 | 485431.05 |

| 113 | 485431.05 | 6011.41 | 2427.1552 | 8438.57 | 479419.63 |

| 114 | 479419.63 | 6041.47 | 2397.0982 | 8438.57 | 473378.16 |

| 115 | 473378.16 | 6071.68 | 2366.8908 | 8438.57 | 467306.49 |

| 116 | 467306.49 | 6102.04 | 2336.5324 | 8438.57 | 461204.45 |

| 117 | 461204.45 | 6132.55 | 2306.0223 | 8438.57 | 455071.90 |

| 118 | 455071.90 | 6163.21 | 2275.3595 | 8438.57 | 448908.70 |

| 119 | 448908.70 | 6194.02 | 2244.5435 | 8438.57 | 442714.67 |

| 120 | 442714.67 | 6224.99 | 2213.5734 | 8438.57 | 436489.68 |

| 121 | 436489.68 | 6256.12 | 2182.4484 | 8438.57 | 430233.56 |

| 122 | 430233.56 | 6287.40 | 2151.1678 | 8438.57 | 423946.16 |

| 123 | 423946.16 | 6318.84 | 2119.7308 | 8438.57 | 417627.32 |

| 124 | 417627.32 | 6350.43 | 2088.1366 | 8438.57 | 411276.89 |

| 125 | 411276.89 | 6382.18 | 2056.3844 | 8438.57 | 404894.70 |

| 126 | 404894.70 | 6414.09 | 2024.4735 | 8438.57 | 398480.61 |

| 127 | 398480.61 | 6446.17 | 1992.4030 | 8438.57 | 392034.44 |

| 128 | 392034.44 | 6478.40 | 1960.1722 | 8438.57 | 385556.05 |

| 129 | 385556.05 | 6510.79 | 1927.7802 | 8438.57 | 379045.26 |

| 130 | 379045.26 | 6543.34 | 1895.2263 | 8438.57 | 372501.92 |

| 131 | 372501.92 | 6576.06 | 1862.5096 | 8438.57 | 365925.86 |

| 132 | 365925.86 | 6608.94 | 1829.6293 | 8438.57 | 359316.92 |

| 133 | 359316.92 | 6641.98 | 1796.5846 | 8438.57 | 352674.94 |

| 134 | 352674.94 | 6675.19 | 1763.3747 | 8438.57 | 345999.74 |

| 135 | 345999.74 | 6708.57 | 1729.9987 | 8438.57 | 339291.17 |

| 136 | 339291.17 | 6742.11 | 1696.4559 | 8438.57 | 332549.06 |

| 137 | 332549.06 | 6775.82 | 1662.7453 | 8438.57 | 325773.24 |

| 138 | 325773.24 | 6809.70 | 1628.8662 | 8438.57 | 318963.53 |

| 139 | 318963.53 | 6843.75 | 1594.8177 | 8438.57 | 312119.78 |

| 140 | 312119.78 | 6877.97 | 1560.5989 | 8438.57 | 305241.81 |

| 141 | 305241.81 | 6912.36 | 1526.2091 | 8438.57 | 298329.46 |

| 142 | 298329.46 | 6946.92 | 1491.6473 | 8438.57 | 291382.53 |

| 143 | 291382.53 | 6981.66 | 1456.9127 | 8438.57 | 284400.88 |

| 144 | 284400.88 | 7016.56 | 1422.0044 | 8438.57 | 277384.31 |

| 145 | 277384.31 | 7051.65 | 1386.9216 | 8438.57 | 270332.67 |

| 146 | 270332.67 | 7086.90 | 1351.6633 | 8438.57 | 263245.76 |

| 147 | 263245.76 | 7122.34 | 1316.2288 | 8438.57 | 256123.42 |

| 148 | 256123.42 | 7157.95 | 1280.6171 | 8438.57 | 248965.47 |

| 149 | 248965.47 | 7193.74 | 1244.8274 | 8438.57 | 241771.73 |

| 150 | 241771.73 | 7229.71 | 1208.8587 | 8438.57 | 234542.02 |

| 151 | 234542.02 | 7265.86 | 1172.7101 | 8438.57 | 227276.16 |

| 152 | 227276.16 | 7302.19 | 1136.3808 | 8438.57 | 219973.98 |

| 153 | 219973.98 | 7338.70 | 1099.8699 | 8438.57 | 212635.28 |

| 154 | 212635.28 | 7375.39 | 1063.1764 | 8438.57 | 205259.89 |

| 155 | 205259.89 | 7412.27 | 1026.2994 | 8438.57 | 197847.62 |

| 156 | 197847.62 | 7449.33 | 989.2381 | 8438.57 | 190398.29 |

| 157 | 190398.29 | 7486.58 | 951.9914 | 8438.57 | 182911.71 |

| 158 | 182911.71 | 7524.01 | 914.5586 | 8438.57 | 175387.70 |

| 159 | 175387.70 | 7561.63 | 876.9385 | 8438.57 | 167826.07 |

| 160 | 167826.07 | 7599.44 | 839.1304 | 8438.57 | 160226.63 |

| 161 | 160226.63 | 7637.44 | 801.1332 | 8438.57 | 152589.20 |

| 162 | 152589.20 | 7675.62 | 762.9460 | 8438.57 | 144913.58 |

| 163 | 144913.58 | 7714.00 | 724.5679 | 8438.57 | 137199.58 |

| 164 | 137199.58 | 7752.57 | 685.9979 | 8438.57 | 129447.00 |

| 165 | 129447.00 | 7791.33 | 647.2350 | 8438.57 | 121655.67 |

| 166 | 121655.67 | 7830.29 | 608.2784 | 8438.57 | 113825.38 |

| 167 | 113825.38 | 7869.44 | 569.1269 | 8438.57 | 105955.94 |

| 168 | 105955.94 | 7908.79 | 529.7797 | 8438.57 | 98047.15 |

| 169 | 98047.15 | 7948.33 | 490.2358 | 8438.57 | 90098.82 |

| 170 | 90098.82 | 7988.07 | 450.4941 | 8438.57 | 82110.74 |

| 171 | 82110.74 | 8028.01 | 410.5537 | 8438.57 | 74082.73 |

| 172 | 74082.73 | 8068.15 | 370.4137 | 8438.57 | 66014.58 |

| 173 | 66014.58 | 8108.50 | 330.0729 | 8438.57 | 57906.08 |

| 174 | 57906.08 | 8149.04 | 289.5304 | 8438.57 | 49757.04 |

| 175 | 49757.04 | 8189.78 | 248.7852 | 8438.57 | 41567.26 |

| 176 | 41567.26 | 8230.73 | 207.8363 | 8438.57 | 33336.53 |

| 177 | 33336.53 | 8271.89 | 166.6826 | 8438.57 | 25064.64 |

| 178 | 25064.64 | 8313.25 | 125.3232 | 8438.57 | 16751.40 |

| 179 | 16751.40 | 8354.81 | 83.7570 | 8438.57 | 8396.59 |

| 180 | 8396.59 | 8396.59 | 41.9829 | 8438.57 | 0.00 |

两种还款方式比较分析

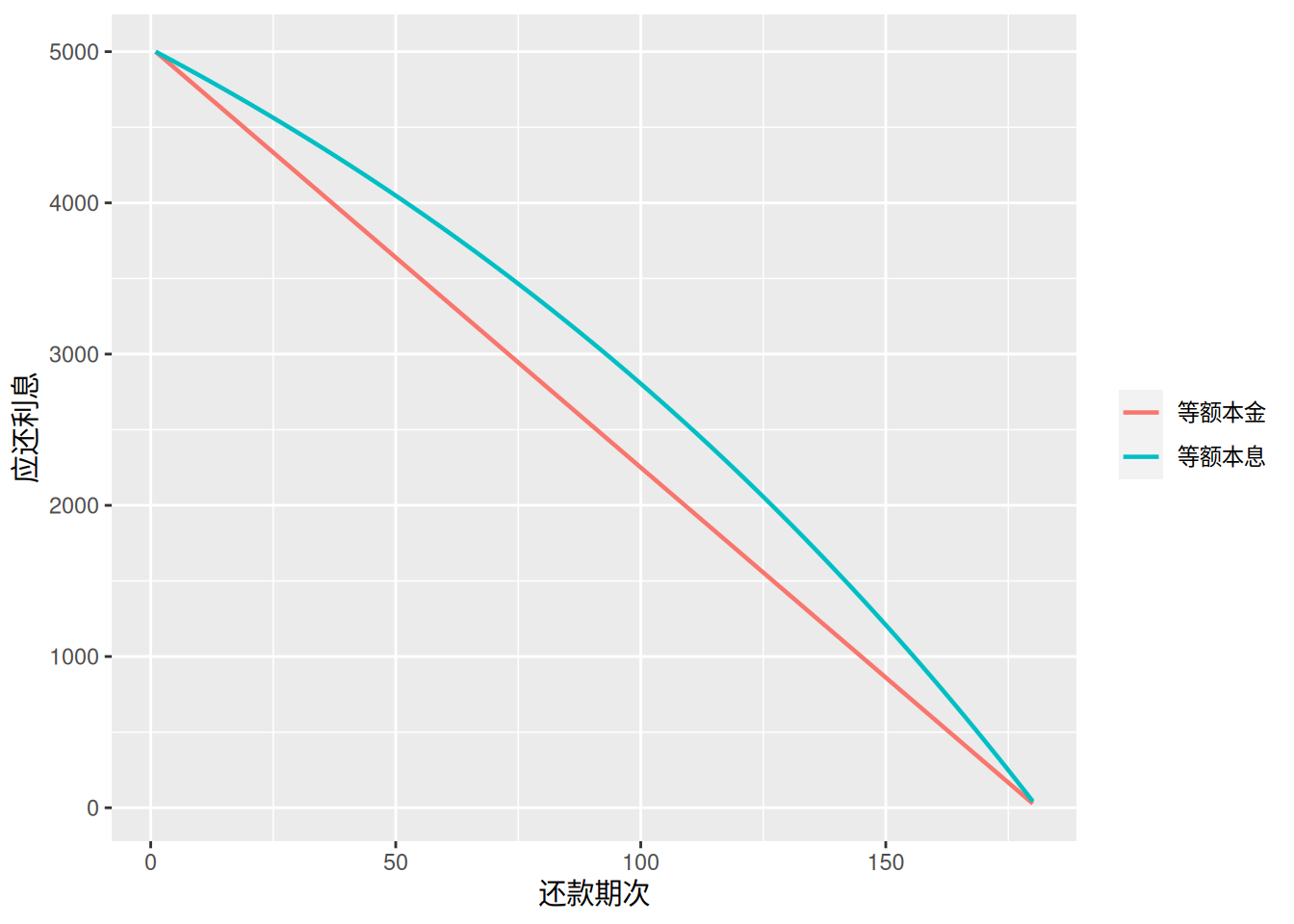

月还款利息对比

df1$mode = "等额本金"

df2$mode = "等额本息"

df = rbind(df1, df2)

df %>%

ggplot(aes(`还款期次`, `应还利息`, color = mode)) +

geom_line(linewidth = 0.8) +

theme(legend.title = element_blank())

# 等额本金累计还利息

interest_mode1 = sum(df1$`应还利息`)

# 等额本息累计还利息

interest_mode2 = sum(df2$`应还利息`)

# 大小判断

direction = ifelse(

interest_mode1 > interest_mode2,

"等额本金累计还利息比等额本息方式多",

"等额本金累计还利息比等额本息方式少"

)

# 计算差异

change = abs(interest_mode1 - interest_mode2)

从上图我们可以可以清洗地发现:等额本金累计还利息比等额本息方式少。 统计结果显示: 等额本金累计还利息452500.00元, 等额本息累计还利息518942.29元, 两者相差66442.29元。

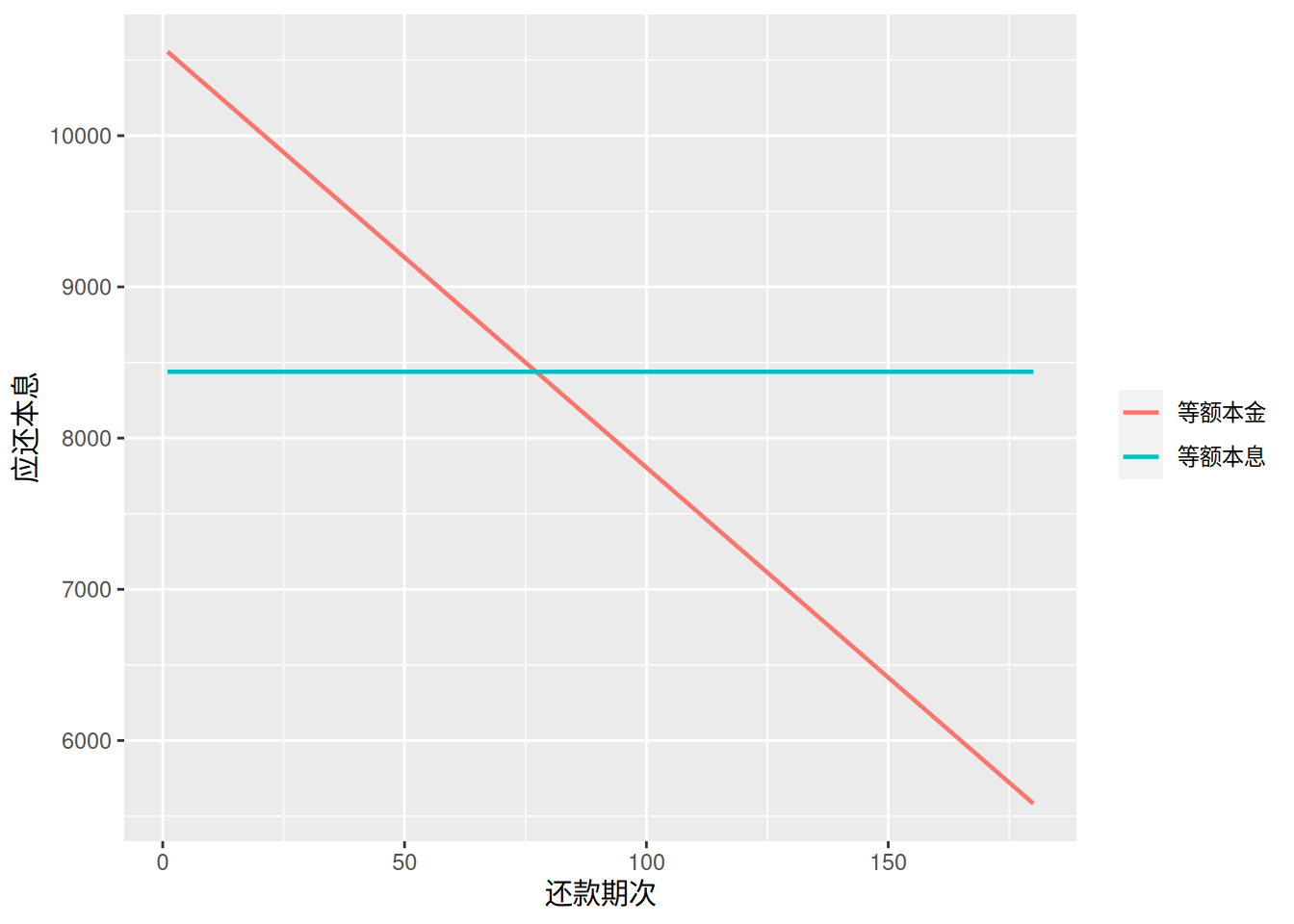

月还本息对比

df %>%

ggplot(aes(`还款期次`, `应还本息`, color = mode)) +

geom_line(linewidth = 0.8) +

theme(legend.title = element_blank())

从图上可以看出,等额本金还款模式前期还款压力较大,后期还款压力逐渐递减,等额本息模式每期还款压力不变。

红线与坐标轴围成的面积即为等额本金下还款总额。同理,蓝线与坐标轴围成的面积即为等额本息下还款总额;很明显蓝线围成的面积更大,即等额本息还款总额较多。

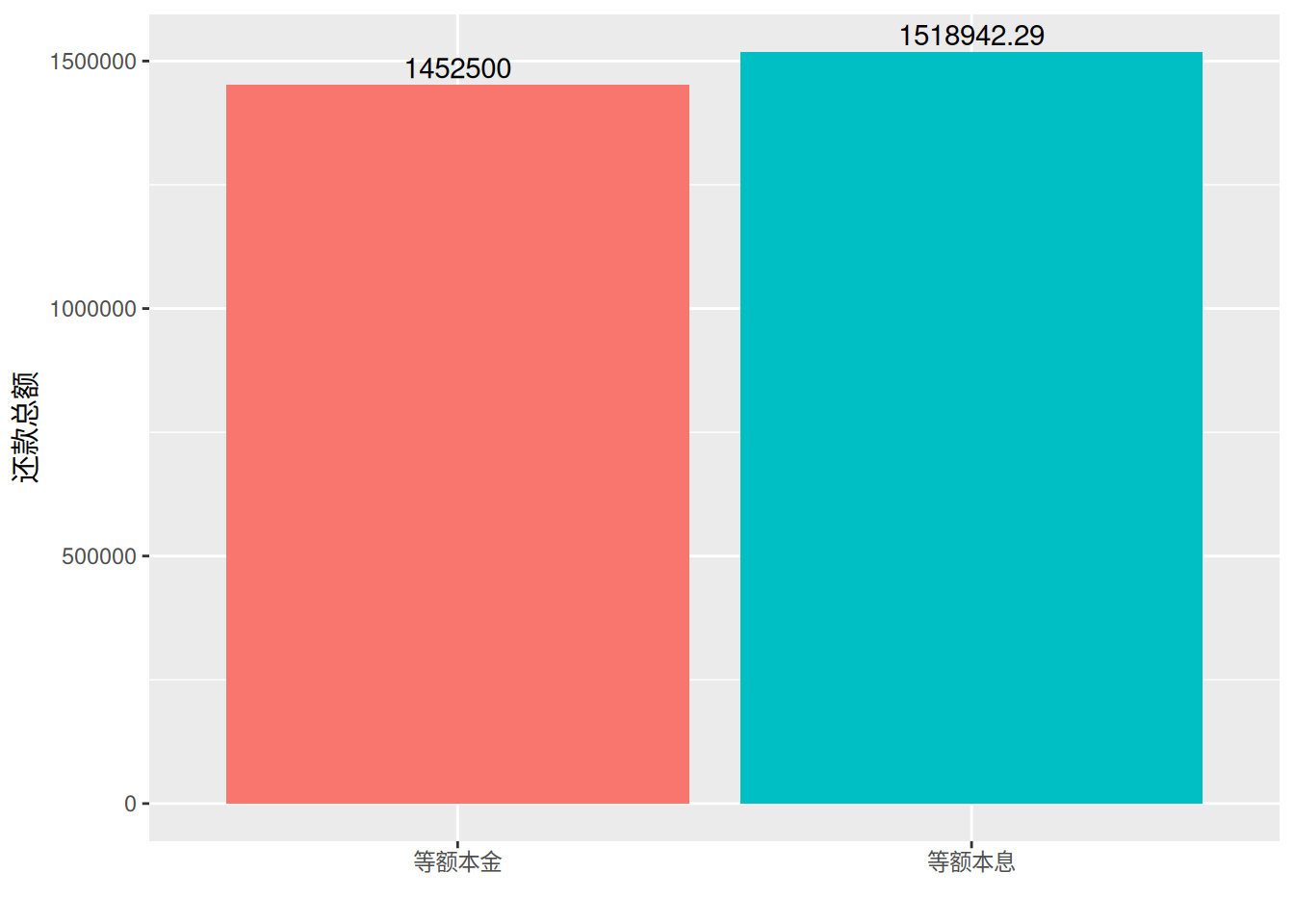

还款总额对比

df %>%

group_by(mode) %>%

summarise(`还款总额` = round(sum(`应还本息`), 2)) %>%

ggplot(aes(mode, `还款总额`, fill = mode)) +

geom_bar(stat = "identity") +

geom_text(aes(label = `还款总额`), vjust = -0.3) +

xlab("") +

guides(fill = "none")

从总还款额同样也能清晰地看出等额本金累计还利息比等额本息方式少。